Warren Buffet, arguably the world’s most successful investor, has long championed the ‘buy-and-hold’ investment strategy on quality stocks. It’s a philosophy many aspire to, but history has shown that rarely do we have the patience.

Patience – and more specifically the lack of it – like greed, fear and even joy, are the very human emotions that can impact an investor’s ability to make rational investment decisions.

These emotions are particularly apparent in times of high market volatility – but what is volatility and how does it affect the market?

Market volatility and its effect on the market

If you see your share portfolio rise for three days, plunge for two and rally for another five – maybe for no net gain or loss – what you are witnessing is the market’s volatility.

As a finance geek, mathematically, volatility is derived from the fluctuation, (or standard deviations), of a security’s price around its average price over a period of time.

To put it simply, volatility is a reflection of investor sentiment based on the risk they see in the market.

Studies have shown that periods of high volatility are often associated with falling markets. This is somewhat intuitive as investors often react emotionally, selling their investments when prices fluctuate wildly and downside risk increases.

Conversely, periods of low volatility often reflect an increasing market and as fund managers and investors become more content, so too are the risks of a market correction.

What affects market volatility?

Whilst there is often no one cause for volatility over any time frame, there are some conditions which can lead to market volatility, including the likelihood of government influence and intervention, the perception of a market bubble (eg dot com, housing), instability in global affairs and more generally any situation where investors cannot get a reliable picture of the future.

Our Top tips for living with market volatility

1) No-one can time the market ‘Timing the market’ – that is, consistently selling high and buying low is very difficult. Unfortunately, markets are unpredictable and attempting this can leave investors prone to missing out on relief rallies – not to mention the tax implications on profit-taking.

For that reason, we believe in the old mantra – “time in the market is more

important than timing”.

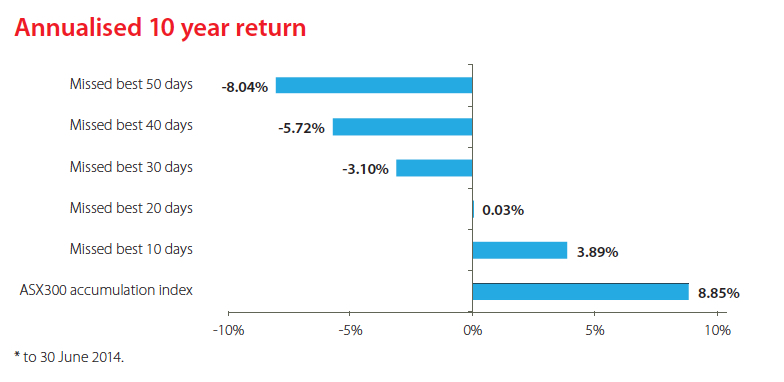

Investors who stay out of the market, trying to pick the best time to invest, risk missing out on market rebounds. As you can see from the graph below, to 30 June 2014, missing out on just 20 of the best trading days in Australia over the last 10 years virtually erased any gain you made.

Importantly, it also lets you take the emotion out of investing and frees you up from watching the market every day.

2) Avoid emotion-driven selling – Often in a strong market rally, any downturn can be seen as an opportunity to take profits, while a more prolonged correction can lead to sentiment-driven selling (or jumping between investments).

That is, as one group of investors sell, the next group sell on the market decline, with little consideration for the market fundamentals.

However emotion-driven selling can ultimately lower the long-term returns on your portfolio, as you are then faced with trying to re-enter a rising market. For this reason, there are some important factors you should consider before deciding to sell.

- What is your investment time horizon? If you are more than a few years away from retirement, even a major market correction will seem like just a blip in your investment history in the coming years.

- Are you remaining true to your initial financial objectives?

- Fund managers are more adept at counter-emotional investing, as well as understanding the market fundamentals (however, even the best fund managers have periods

of short-term underperformance). Remember, once you exit the market it can be very hard to emotionally re-establish yourself and go through the cycle of emotions again.

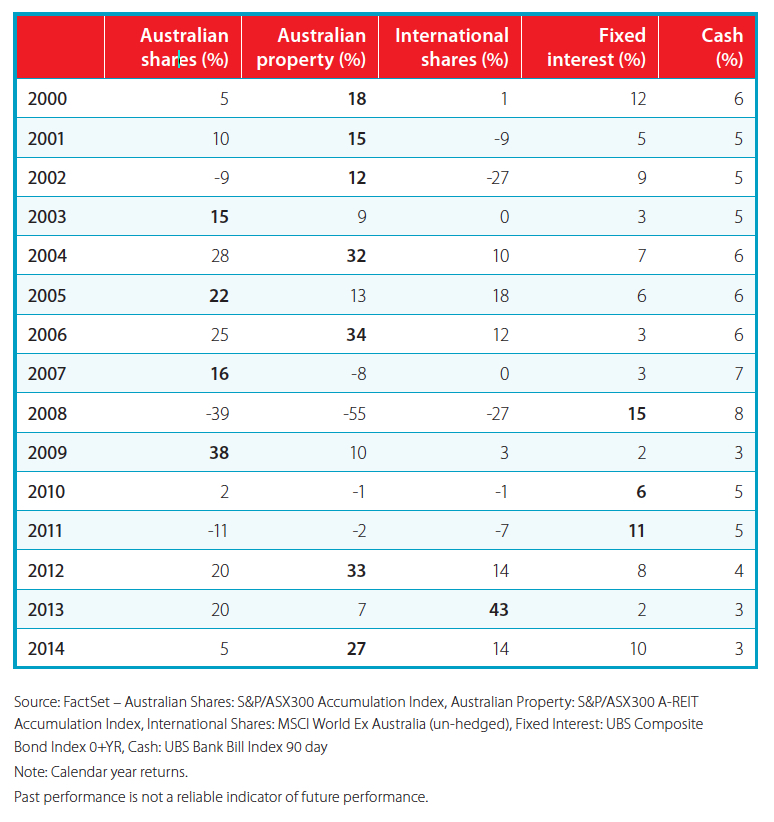

3) Diversification is key – Trying to predict which asset class, be it shares, cash, fixed interest or even property, will outperform others in any one year can be as difficult as trying to time the market.

As the table below demonstrates, over the last 15 years most asset classes have had periods of relative outperformance. Further, those that post the largest gains in good years – such as Australian property – can also be hardest hit when the market turns. However, if you are sufficiently diversified across the asset classes, your broader investment is hedged against periods of high volatility and portfolio risk is smoothed out.

To Sum Up

Over time, the share market has shown itself to be more volatile than other asset classes, however it has also offered solid returns overtime, and patience in investing to protect against volatility is essential. That’s why investors should seek professional financial advice along the way as needed and be prepared to invest for the long-term (ie five years or more) to ride out periods of volatility.

Investors who remain focused on their investment approach despite periods of volatility, have a greater chance of achieving their goals. As always if you want more information about your situation contact our office today.