Last night Federal Treasurer Joe Hockey presented his second Federal Budget. I am personally glad the messaging of this years budget has changed from one of ‘budget emergencies’ however the impact on the economy with the focus on ‘fairness, small business and families’ will depend on how much confidence can be improved. There were few surprises in the budget as many of the big items where leaked prior to budget night however we have prepared the attached analysis and commentary based on the readings we have done so far.

Last night Federal Treasurer Joe Hockey presented his second Federal Budget. I am personally glad the messaging of this years budget has changed from one of ‘budget emergencies’ however the impact on the economy with the focus on ‘fairness, small business and families’ will depend on how much confidence can be improved. There were few surprises in the budget as many of the big items where leaked prior to budget night however we have prepared the attached analysis and commentary based on the readings we have done so far.

While the messaging has changed the bottom line of the budget is worse than 12 months ago due to income reductions for the Government from lower commodity prices. The ‘return to surplus’ has been delayed by a further 12 months to 2019-20. The deficit for this current budget is projected to be around $35billion or 2.1% of Gross Domestic Product. Overall it is expected that these budget announcements will have little impact on investment markets however some corporates will benefit from the planned infrastructure spending. From my reading of the current announcements the aim of this budget really has been to increase economic confidence and provide different messaging to try and turn around the debacle from last years budget.

Before reading the below note that these are only announcements and will require passage through Parliament before being legislated.

Personal Taxation

There are no announced changes to personal tax rates within this current years budget measures unless you are a small business operator.

Fringe Benefits Tax – For staff of Not for Profits and Public Benevolent Institutions (PBI’s)

-

The Government will limit the amount employees of public benevolent institutions and health promotion charities can salary sacrifice for meal entertainment benefits. The limit will be a separate single grossed up amount of $5,000. The amounts exceeding this cap can also be counted in calculating whether an employee exceeds their existing fringe benefits tax (FBT) exemption or rebate cap. All use of meal entertainment benefits will become reportable and this measure will apply prospectively from 1 April 2016.

MM Comment: I have noted overtime that this is an area which was due for changes based on its previous generosity. If you are an employee of a PBI or Not for Profit that allows these benefits your employer will provide information on these changes however you should review your overall situation.

Higher Education Loan Programme (HECS / HELP debts)

- The Government will extend the HELP/HECS repayment framework to debtors residing overseas for more than 6 months. People with a HELP / HECS debt will be required to make repayments if their worldwide income exceeds the minimum repayment thresholds currently set for Australian Tax Residents. If successful this measure will commence from 1 July 2017 for income earned in the 2016-2017 financial year.

Medicare Levy

- The Government will increase the Medicare levy low-income thresholds for singles, families and single seniors and pensioners to take into account of movements in the Consumer Price Index. Taxpayers with taxable income below this threshold are exempt from paying Medicare Levy. These changes are to apply from 1 July 2015.

Work Related Cars

- The Government will make changes to the calculation method for work-related car expense deductions. The ‘12% of original value method’ and the ‘one-third of actual expenses method’ will be removed. The ‘cents-per kilometre method’ will be modernised by replacing the three current rates based on engine size with one rate set at 66 cents per kilometre to apply to all motor vehicles, irrespective of engine size. The ‘log-book’ method will be retained and these changes will not affect leasing and salary sacrifice arrangements.

Employee Share Schemes

- The Government will make further amendments to the proposed changes to taxation of Employee Share Schemes (ESS) from 1 July 2016. The aim is to make ESS more accessible for Australian businesses and their employees, especially start ups.

Fly-In-Fly-Out Workers (Zone Tax Offset)

- The Zone Tax Offset applies to individuals in recognition of the isolation, uncongenial climate and high cost of living associated with living in identified locations. Eligibility is based on defined geographic locations.

- Fly-in fly-out (FIFO) workers whose normal place of residence is outside the remote ‘zone’ will be ineligible for the Zone Tax Offset (ZTO). Currently, workers whose normal place of residence is outside the ‘zone’ can benefit from a tax offset by working in a specified remote area for more than 183 days in an income year. The Government says this measure is designed to better target the ZTO to people who have taken up genuine residence in remote zones. This measure will take effect from 1 July 2015.

Tax Residency for Temporary Working Holiday Makers

- Currently, a working holiday maker is treated as a resident for tax purposes if they satisfy the tax residency rules, typically that they are in Australia for more than six months. This means they are able to access the tax-free threshold, the low income tax offset (LITO) and the lower tax rate of 19% for income above the tax free threshold up to $37,000.

- People who are temporarily in Australia for a working holiday will be treated as non-residents for tax purposes, regardless of how long they are here. This means they will be taxed at 32.5% from their first dollar of income. This measure is proposed to apply from 1 July 2016.

Youth Employment Incentives

- From 1 July 2015, the Government will enhance youth employment activities over four years. The measures include:

- engaging early school leavers, including an activity test from 1 January 2016

- community based intensive support services for young people at high risk of long term unemployment and welfare dependency

- strengthened compliance arrangements including increased penalties for failure to meet mutual obligation requirements

- extending the ‘no show no pay’ principle to missed appointments and work for the dole from 1 July 2016

- potential suspension of income support payments

- implementing a single wage subsidy pool replacing four existing subsidy programmes (Youth, Long term, Restart and Tasmanian) and enhancing the subsidy arrangements from 1 July 2015

- extending the National Work Experience Programme

- delaying the implementation of the age increase for Newstart and Sickness allowances from 22 to 25 years of age until 1 July 2016.

Write off for Primary Producers

- The Government is prepared to spend $70 million over the next four years bringing forward tax deductions available for farmers. These measures will be effective from 1 July 2016.

Improved write-off provisions for primary producers will bring forward depreciation periods of up to 50 years down to between one and three years for fences, water facilities and fodder storage assets.

Superannuation

As promised there were no major changes to superannuation tax rates. This means the Division 293 tax will still apply for income earners over $300,000.

Terminal Illness Provisions

- The Government will extend access to superannuation for people with a terminal medical condition from 12 months to 24 months. The process of requiring two medical practitioner certificates (including one from a specialist) and the tax-free treatment of funds accessed from superannuation under this condition will remain unchanged.

Supervisory Levy for Institutions

- The Government will increase the supervisory levies paid. This is designed to fully recover the cost of superannuation activities undertaken by the Australian Taxation Office and the Department of Human Services, consistent with the Government’s cost recovery guidelines. The measure is expected to raise additional revenue of $46.9 million over four years from 2015-16.

MM Comment: We have seen over the last few years this rate increase for SMSF trustees and it will occur again.

Lost and Unclaimed Super Accounts

- The Government will implement a package of measures that will reduce red tape for superannuation funds and individuals. The measure removes redundant reporting obligations and streamlines lost and unclaimed superannuation administrative arrangements. The changes will make it easier for individuals to claim their lost and unclaimed superannuation. The measures will have effect from 1 July 2016.

Social Security and Family Payments

Paid Parental Leave

- Currently individuals are able to access Government assistance under the existing Parental Leave Pay (PLP) scheme, in addition to any employer-provided parental leave entitlements. The Government will remove the ability for individuals to ‘double dip’, by taking payments from both their employer and the Government. The Government will ensure that all primary carers would have access to parental leave payments that are at least equal to the maximum PLP benefit (currently 18 weeks at the national minimum wage). The Government will achieve savings of $967.7 million over four years by removing this duplication from 1 July 2016.

Family Tax Benefits Part A

- The Government will remove the additional Family Tax Benefit (FTB) Part A Large Family Supplement from 1 July 2016. Families will continue to receive a per child rate of FTB Part A for each eligible child in their family. The Government will achieve savings of $177.3 million over four years from this measure.

- The Government will achieve further savings of $42.1 million over five years by reducing the amount of time Family Tax Benefit (FTB) Part A will be paid to recipients who are outside Australia. From 1 January 2016, families will only be able to receive FTB Part A for six weeks in a 12 month period while they are overseas. Currently, FTB Part A recipients who are overseas are able to receive their usual rate of payment for six weeks and then the base rate for a further 50 weeks. Portability extension and exception provisions which allow longer portability under special circumstances will continue to apply.

Child Care Subsidy

- The Government will provide an additional $3.2 billion over five years from 2014-15 to support families with flexible, accessible and affordable child care so they can move into work, stay in work, train, study or undertake other recognised activities.

- A new single Child Care Subsidy (CCS) will be introduced on 1 July 2017 and will replace the current child care fee assistance provided by the Child Care Benefit, Child Care Rebate and the Jobs, Education and Training Child Care Fee Assistance payments, which will cease on 30 June 2017, which will cease on 30 June 2017. Families meeting the activity test with annual incomes up to $60,000 (2013-14 dollars) will be eligible for a subsidy of 85 per cent of the actual fee paid, up to an hourly fee cap. The subsidy will taper to 50 per cent for eligible families with annual incomes of $165,000. The CCS will have no annual cap for families with annual incomes below $180,000. For families with annual incomes of $180,000 and above, the CCS will be capped at $10,000 per child per year. The income threshold for the maximum subsidy will be indexed by the Consumer Price Index (CPI) with other income thresholds aligned accordingly.

Eligibility will be linked to a new activity test to align receipt of the subsidy with hours of work, study or other recognised activities (hours of activity per fortnight / number of hours of subsidy per fortnight):

- 8 to 16 hours – Up to 36 hours

- 17 to 48 hours – Up to 72 hours

- 49 or more hours – Up to 100 hours

The hourly fee cap in 2017-18 will be set at:

- $11.55 for long day care,

- $10.70 for family day care, and

- $10.10 for outside school hours care.

The hourly fee caps will be indexed by CPI.

If this passes parliament in 2017-18, the family income thresholds will be $65,710 (maximum subsidy), $170,710 (minimum subsidy) and $185,710 (application of the annual cap of $10,000). The annual cap will be indexed by CPI from 1 July 2018.

Child Care – Interim Home Based Care Program

- A new Interim Home Based Carer Subsidy Program will subsidise care provided by a nanny in a child’s home from 1 January 2016. The pilot program will extend fee assistance to the parents of approximately 10,000 children. Families selected to participate will be those who are having difficulty accessing child care with sufficient flexibility. Support for families will be based on the CCS parameters, but with a fee cap of $7.00 per hour per child.

Low Income Support Supplement

- The Government will cease the Low Income Supplement from 1 July 2017. Recipients of most Government payments will continue to receive carbon tax compensation through the Energy Supplement, which provides up to $14.10 per fortnight depending on individual circumstances.

Social Security Income and Asset Tests

- The Government will introduce measures to limit the proportion of income that can be excluded from any income test (the deductible amount) at 10% from 1 January 2016.

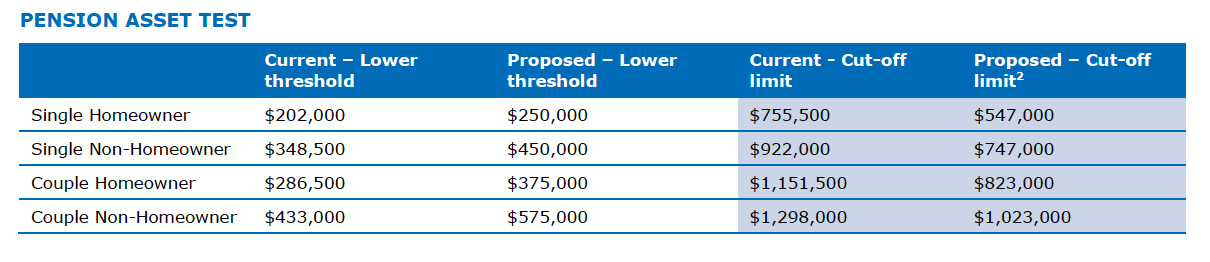

This will impact pensioners on defined benefit income streams (paid from a public sector or other corporate defined benefit superannuation fund). Under current arrangements, some defined benefit superannuants are able to have a large proportion of their superannuation income excluded from the pension income test. This measure introduces a limit on the superannuation income stream amount that can be excluded from relevant social security income tests. Recipients of Veterans’ Affairs pensions and/or defined benefit income streams paid by military superannuation funds are exempt from this measure. - From 1 January 2017, the pension asset test will have the following changes, increase the ‘asset free areas’ for both homeowners and non-homeowners and increase the asset test taper from $1.50 per fortnight to $3.00 per fortnight per $1,000 of assets over the lower threshold.

- The government estimates that approximately 12% of pensioners will lose entitlement to the pension as a result of the changes to the asset test. These people will automatically be issued with a Commonwealth Seniors Health Card, or a Health Care Card for those under pension age.

Pension Portability

- From 1 January 2017, those affected by proportional pension portability will have their rate of pension reduced after six weeks from leaving Australia rather than the current 26 week period. Affected payments include Age Pension, Wife Pension, Widow B Pension and the Disability Support Pension. People affected by proportional pension portability include those who have less than 35 years Australian Working Life Residence. Australian Working Life Residence refers to the period of time a person has resided in Australia between the ages of 16 and age pension age. Pensioners overseas at the date of implementation are not affected unless they return to Australia and make a subsequent overseas trip.

Aged Care Measures

-

The Government is changing the aged care means testing arrangements for new residents entering aged care from 1 January 2016. This measure will align aged care means testing arrangements for residents who pay their accommodation costs by periodic payments with the arrangements that currently apply to those residents who pay via a lump sum. This will remove the rental income exemption under the aged care means test for aged care residents who are renting out their former home and paying their aged care accommodation costs by periodic payments. Existing protections such as annual fee caps and lifetime fee caps remain.

- The Government will incorporate short term restorative care places into the aged care planning ratio from 1 July 2016. This measure will result in an overall increase in the number of short term restorative aged care places to support older Australians regain mobility and confidence to live safely at home after a period of hospitalisation, and reduce the number of premature admissions into permanent residential care. The measure will ensure that the growth in short term restorative care places matches the growth in the aged population.

- From 1 February 2017, Home Care Packages will be allocated directly to consumers by the My Aged Care Gateway rather than to service providers through the Aged Care Approvals Round. To be eligible for a package, a consumer would be assessed by an Aged Care Assessment Team to determine the appropriate level of assistance and their care needs. The My Aged Care Gateway will be responsible for prioritising clients’ access to packages at the regional level within the number of packages allocated through the planning ratio. This will enable aged care recipients to receive services from a provider of their choice, including the ability to change providers.

Small Business

The Government has definitely focused this budget on supporting small business.

Tax Cuts and Discounts

- The Government will provide a tax cut for all small businesses with aggregated annual turnover of less than $2m of 1.5%. This will reduce the company tax rate for small businesses from 30% to 28.5% for the 2015-16 financial year.

- Individual tax payers (sole-traders and partners within a partnership) with an unincorporated business that has an aggregated annual turnover of less than $2m will be eligible for a small business tax discount. The discount will be 5% of the income tax payable on the business income received and will be capped at $1,000 per individual per year. The discount will be delivered as a tax offset.

Immediate Tax Deduction for Items Under $20,000

- The Government will allow small businesses with aggregated annual turnover of less than $2m, the immediate deduction of assets for that they start to use or install ready for use, provided the asset cost less than $20,000. This will apply to assets acquired and installed ready for use between 7.30pm 12 May 2015 to 30 June 2017. The small business simplified depreciation pool can also be immediately deducted if the balance is less than $20,000 over this period (including existing pools).

Capital Gains Tax Relief for Changes to Entity Structure

- The Government will allow small businesses with an aggregated annual turnover of less than $2m to change legal structure without attracting a capital gains tax liability at that point. This measure will be available for businesses that change entity type from 2016-17.

Fringe Benefits Tax Changes – Small electronic devices

- The Government will allow a FBT exemption from 1 April 2016 for small businesses with an aggregated annual turnover of less than $2m. This FBT exemption will apply to those small businesses that provide employees with more than one qualifying work-related portable electronic device.

Start-Up Incentives

The Government is encouraging start-ups by implementing the following incentives:

- Immediate deduction of professional expenses incurred when beginning a business, such as legal expenses on establishing a company, trust or partnership. This replaces the existing rule which requires writing them off over 5-years.

- Streamlined business registration processes will make it quicker and simpler to set up a new business – a single online registration site will be established to facilitate business registration.

- Removing obstacles to crowd-sourced equity funding to help promote small businesses access to finance.

Other Items of Interest

Reversal of banking and life insurance unclaimed provisions

- From 31 December 2015, the time after which inactive bank accounts will be paid to the Government as unclaimed monies, will be restored from the current three years back to seven years. The reduction from seven years to three was implemented in 2012. Children’s bank accounts will be exempt. The Government will also address identity theft and privacy concerns that have arisen from the requirement for ASIC to publish personal details in the Unclaimed Money Gazette.

Goods and Services Tax Changes

- GST will begin to apply to cross-border supplies of digital products imported by consumers. Digital products extends to movies, music, apps, games, e-books and other services in consultancy and professional services. In the interests of efficiency, sometimes it will be the operator of the electronic distribution who will be liable to collect the GST rather than the supplier. The broader GST will apply from 1 July 2017 and is estimated to raise $350 million over four years.

MM Comment: Personally I will be watching this area with great interest to see any impact or how this will be managed as we use a number of offshore service providers (including our e-news provider).

Again as with all budget announcements these need to get pass through as legislation however if you have any questions with regards to your current arrangements please do not hesitate in contacting our office 1300 772 643.