Be aware of the news as it plays out but look behind the hype and the headlines and stay the course in your investment approach.

The S&P/ASX200 peaked on 29th August at 6,352 points and has since declined around 10% as at time of writing today, which places the market in a technical correction. The news will have some solid reporting on this over the coming days I imagine so try to avoid getting caught up in the fear.

While downside is often concerning, especially when it happens over the course of a month, it isn’t unusual. The current downside is the largest we have seen since late 2015 which saw the index fall around 20% from peak to trough but this one took a full year to play out.

Economically we have been in a bull market for a number of years now which means things have been appreciating and there is concern that this may switch things back into a bear market (downturn) however economically this usually aligns with a recession which based on current economic numbers both here in Australia and the US isn’t the case.

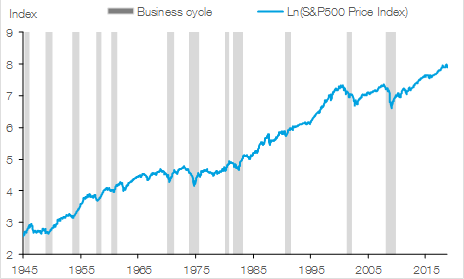

During these times it is important to stay the course and continue to average into markets as opportunities present. Check out the below graph which takes the US S&P500 index back to 1940’s the trend is upwards and this is why as mentioned above, having the right asset allocation is key.

Some are saying this is the correction we had to have on the back of the share markets providing solid returns over the last few years. With this adjustment underlying valuations have returned to more reasonable levels with a possible positive being our dollar moving below $0.70 US but this has been quiet solid still.

As always if you have any questions or concerns please do not hesitate in contacting me at the office.

Seek out further advice and start your journey to being free around your money and creating wealth with understanding.

Scott Malcolm has been awarded the internationally recognised Certified Financial Planner designation from the Financial Planning Association of Australia and is Director of Money Mechanics. Money Mechanics is a fee for service financial advice firm who partner with clients in Melbourne, Canberra, Newcastle and Sydney to achieve their life and wealth outcomes. Money Mechanics Pty Ltd (ABN 64 136 066 272) is a Corporate Authorised Representative (No. 336429) of Infocus Securities Australia Pty Ltd (ABN 47 097 797 049) AFSL and Australian Credit Licence No. 236523

The information provided on this article is of a general nature only. It has been prepared without taking into account your objectives, financial situation or needs. Before acting on this information you should consider its appropriateness having regard to your own objectives, financial situation and needs.