Personally I had been enjoying the lead up commentary around the Federal Budget as Scott (Morrison) and Malcolm (Turnbull) have been preparing us for ‘not just another budget’ but an ‘economic plan’. Being Sco-Mo’s first Budget as Treasurer and one which is a pre election budget there have been some changes which were not expected and professionally I am a little disappointed with some of the superannuation measures which add complexity back to the system.

Personally I had been enjoying the lead up commentary around the Federal Budget as Scott (Morrison) and Malcolm (Turnbull) have been preparing us for ‘not just another budget’ but an ‘economic plan’. Being Sco-Mo’s first Budget as Treasurer and one which is a pre election budget there have been some changes which were not expected and professionally I am a little disappointed with some of the superannuation measures which add complexity back to the system.

This is a little bit of a lengthy article but we have provided some of the highlights to Budget 2016, so grab your morning coffee or tea and if you have any questions please do not hesitate in contacting me at the office.

Before reading the below note that these are only announcements and will require passage through Parliament before being legislated,

with a Federal Election expected on July 2nd some of these measures may not eventuate however it is likely they will have cross bench support as Labor had some tighter plans around the superannuation system proposed before the Coalition came to power in 2013.

Superannuation has been front and centre of the budget with most of the ‘simple super’ reforms from 2006 being adjusted and complexities being reintroduced in order to save money from the tax free retirement savings of Australians. My view is that Super legislation needs to be pulled out of the Budget cycle to give people clarity and certainty around their retirement plans.

Superannuation tax concessions have been heavily tightened, with existing limits reduced and new caps introduced. It seems that the old system of ‘reasonable benefits limits’ on the pension side may be re-enacted in some form especially with the defined benefit super schemes so watch this space as things progress.

In particular, there will be a:

- $1.6 million superannuation transfer balance cap, limiting the amount that can be transferred to retirement (pension) phase (my note – remember there are two parts to superannuation, accumulation phase and pension draw-down phase);

- lowering of the concessional contributions cap to $25,000 (across the board regardless of age);

- limiting of the non-concessional contributions through a lifetime cap for non-concessional contributions of $500,0000;

- the tax exemption for earnings on assets supporting ‘transition to retirement’ income streams will be removed (so tax will be applied at the 15% super rate), and the anti-detriment payment will be abolished;

- a reduction in the threshold from which an extra 15% tax applies on contribution to super, from $300,000 to $250,000; and

- Another change is that individuals will be able to claim a deduction for personal contributions to superannuation, regardless of their employment status. Currently, the deduction is limited to the unemployed, self-employed or ‘substantially self-employed’. My view is that this is a positive step forward.

On the personal tax front, the $80,000 threshold will be raised to $87,000.

There were also big changes for small and medium business, with the thresholds to access certain concessions raised substantially.

Beyond just small and medium businesses, all companies will eventually face a reduced company tax rate, with the rate gliding down to 25% over ten years.

Personal taxation

Although there have been no major changes in relation to personal income tax, some small adjustments have been made. We have reviewed the major changes below.

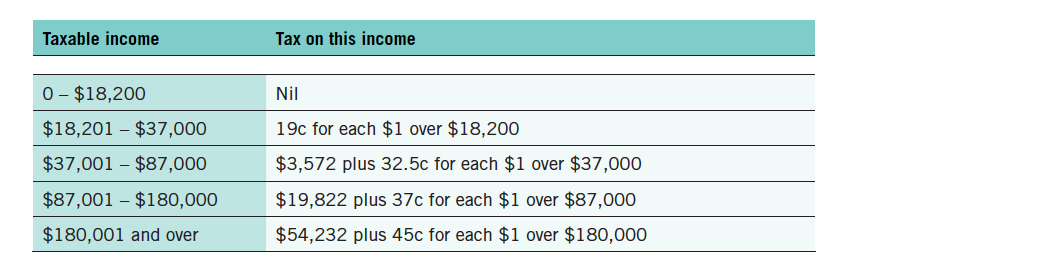

Reduction in personal income tax for middle income earners in an effort to combat bracket creep (increased income tax resulting from wage inflation), the Government has announced an increase in the middle personal income tax bracket from $80,000 to $87,000, effective from the 2016/17 financial year. The table below compares the current tax rates to the rates effective 1 July 2016.

Medicare levy threshold changes

Although this measure has already been legislated, the Budget included the indexation of the Medicare levy low income thresholds, under which people pay no Medicare levy on their earnings, for the current financial year.

Expiration of Budget Repair Levy

The 2 per cent Temporary Budget Repair Levy, introduced by Joe Hockey as part of the 2014/15 Budget is set to expire at the end of the 2016/17 financial year and has not been extended by this year’s budget.

Company Taxes

In line with the Government’s position that this Budget should be seen as an economic plan, substantial consideration has been given to corporate tax affairs. Below we review the major changes relevant to small and medium businesses.

Small business entity turnover threshold

The Government will increase the small business entity turnover threshold from $2.0 million to $10.0 million from 1 July 2016. The current $2.0 million turnover threshold will be retained for access to the small business capital gains tax concessions. Access to the unincorporated small business tax discount will be limited to entities with turnover less than $5.0 million.

This will provide over 90,000 additional small businesses with access to tax concessions including the reduced corporate tax rate and the instant asset write-off provisions.

Small business tax rate and corporate tax rate ten year plan

For the 2016/17 income year the tax rate for businesses with an annual aggregated turnover of less than $10.0 million is proposed to reduce to 27.5 per cent from the 2016/17 income year. The current tax rate for small business is 28.5 per cent for businesses with a turnover of less than $2 million.

This will impact approximately 870,000 small business. Furthermore the Government will implement a phased reduction in the company tax rate to 25 per cent over 10 years.

The turnover threshold will also be progressively increased to ultimately have all companies at 27.5 per cent in the 2023/24 income year. The annual aggregated turnover thresholds for companies facing a tax rate of 27.5 per cent will be:

- $25.0 million in the 2017/18 income year

- $50.0 million in the 2018/19 income year

- $100.0 million in the 2019/20 income year

- $250.0 million in the 2020/21 income year

- $500.0 million in the 2021/22 income year

- $1 billion in the 2022/23 income year.

Unincorporated business tax rates

An 8 per cent unincorporated tax discount will be provided to unincorporated businesses with turnover less than $5 million per annum, capped at $1,000 per individual per year from 1 July 2016 for the following eight years.

Small business CGT concessions

Despite the above changes in relation to small business, the area of capital gains tax exemptions has been retained as is. The current eligibility criteria remains unchanged. For example the aggregated turnover test remains at $2 million and the net asset value at $6 million, however the sting is in the tail. For instance the 15 year rule exemption retains its current upper threshold currently $1.395 million for the 2015/16 income year and the retirement exemption retains its $500,000 lifetime limit. These CGT exempt contributions naturally add towards the $1.6 million maximum capital that can fund a retirement income stream whilst receiving pension earnings tax concession of zero percent.

A great development for small business operators is the removal of the work test for contributions made on or after the age of 65.

Superannuation

For the first time, the objective of superannuation, which is ‘to provide income in retirement to substitute or supplement the Age Pension’ – will be enshrined in legislation.

Taxation of concessional superannuation contributions

Currently those who earn over $300,000 (taxable income plus superannuation contribution) are required to pay an additional 15% contribution tax on their concessional super contributions (i.e. total of 30% contribution tax) – Some may have seen a Division 293 tax notice.

From 1 July 2017, this threshold will reduce to $250,000. The lower threshold will also apply to members of defined benefit schemes and constitutionally protected funds currently covered by the tax. Existing exemptions (such as State higher level office holders and Commonwealth judges) will stay.

The Government will also reduce the annual cap on concessional superannuation contributions to $25,000 (currently $30,000 under age 50; $35,000 for ages 50 and over).

From 1 July 2017, the Government will include notional (estimated) and actual employer contributions in the concessional contributions cap for members of unfunded defined benefit schemes and constitutionally protected funds. For individuals who were members of a funded defined benefit scheme as at 12 May 2009, the existing grandfathering arrangements will continue.

My Comments: for those who are salary sacrificing to superannuation you will need to review your arrangements from 1 July (assuming these measure proceed). There will be added complexity for members of public sector defined benefit super schemes as part of this process.

Allow catch-up concessional contributions

From 1 July 2017, individuals with a superannuation balance less than $500,000 will be able to make additional concessional contributions, provided that they have not reached their concessional contributions cap in previous years.

To work out how much in additional concessional contributions can be made in a given financial year, unused concessional cap amounts from 1 July 2017 can be carried forward on a rolling basis for a consecutive five year period. Amounts carried forward that have not been used after five years will expire.

For example, a person aged 47 earning $100,000 per year, with a $300,000 superannuation balance, makes a concessional contribution of $10,000 in the 2017/18 financial year. In the following financial year, they will be allowed to contribute up to $40,000 into superannuation and the entire $40,000 will be taxed at 15 per cent. The $40,000 comprises of unused concessional cap balance of $15,000 ($25,000 minus $10,000) and the annual concessional cap of $25,000. Currently, this person will be subject to excess concessional contributions tax at their marginal tax rate.

My Comment: This measure will benefit those with interrupted work patterns, such as women and carers, by allowing them to make ‘catch-up’ contributions once they are able to do so. Under the current system, a strict application of annual concessional contributions caps results in a ‘use it or lose it’ system and puts individuals with irregular work patterns at a distinct disadvantage.

Members of defined benefit schemes will also benefit from this proposed measure.

$1.6 million superannuation transfer balance cap

The cap (limit) will apply from 1 July 2017. Subsequent earnings on balances transferred to retirement phase (pension phase) will not be counted towards the limit.

A tax will apply to the extent amounts transferred exceed the $1.6 million cap (including earnings on these excess transferred amounts).

Changes to tax arrangements for pension amounts over $100,000, from defined benefit schemes from 1 July 2017 will achieve commensurate treatment for those schemes.

My Comments: This measure will have impact for our clients who are on defined benefit income streams and who have larger pension account balances. I am not yet sure how they will be determining the valuation method on the Defined Benefit side of things. Historically ‘Reasonable Benefits Limits’ were used to calculate some elements so we may see a return to this type of regime and will likely only impact clients over age 60.

Contributions rules for older Australians

To assist older Australians prepare for their retirement by boosting their superannuation account balances, the Government is lifting restrictions on their ability to contribute.

Currently, there are minimum work requirements for Australians aged 65 to 74 who want to make voluntary superannuation contributions. Restrictions also apply to the bring-forward of non-concessional contributions. In addition, spouses aged over 70 cannot receive contributions. None of these restrictions apply to individuals aged under 65.

The Government will remove these restrictions and instead apply the same contribution acceptance rules for all individuals aged up to 75, from 1 July 2017.

These changes will provide better incentives and more flexibility to all Australians to make superannuation contributions appropriate to their circumstances.

My Comments: This is a good simplification for the Super System for those aged over age 65 as long as you have not exhausted your contribution limits.

Lifetime cap for non-concessional superannuation contributions

From 7:30 pm (AEST) on 3 May 2016, a $500,000 lifetime non-concessional contributions cap (indexed to ordinary times earnings) will apply. Excess contributions will need to be removed from the super system or will be subject to penalty tax. The amount that could be removed from any accumulation accounts will be limited to the amount of non-concessional contributions made into those accounts since 1 July 2007.

All non-concessional made from 1 July 2007 will be counted towards the lifetime cap. However, contributions made before this measure cannot, by themselves, result in an excess amount. The lifetime cap will replace the annual caps (and ‘bring forward’ arrangements), which currently apply. The new cap will allow Australians up to age 74 to make non-concessional contributions.

Different arrangements will apply for defined benefit funds. After-tax contributions to these funds are counted towards the lifetime cap. However, excess contributions don’t have to be removed (and further excess contributions can be made). Instead, the member will be required to remove, on an annual basis, an equivalent amount (including proxy earnings) from any accumulation accounts they hold.

My Comments: I am not a big fan of this measure as the $1.6m cap mentioned above should control the ‘reasonable benefits’ in the system. The back dating of this to 2007 is also going to add some complexity. This measure will mean anyone who has used the bring forward rules to make ‘untaxed’ or ‘non-concessional’ contributions to super will need to review their strategies to ensure they are not over the limits and then plan if they pay the excess tax or remove the funds from the system.

Superannuation income streams – Transition to Retirement

From 1 July 2017, the tax exemption for earnings on assets supporting ‘transition to retirement’ income streams will be removed. These are income streams where the member has reached preservation age but not yet retired.

In addition, the rule allowing individuals to treat certain superannuation income stream payments as lump sums for tax purposes, will be abolished.

The Government has also confirmed that they will remove tax barriers to the development of new retirement income products by extending the tax exemption on earnings in the retirement phase to products such as deferred lifetime annuities and group self-annuitisation products. These products can provide more flexibility and choice for Australian retirees, and help them to better manage consumption and risk in retirement.

This change was recommended by the Retirement Income Streams Review. The Government has released the Review and agreed all its recommendations. The announcement also states that they will consult on how the new retirement income products will be treated under the Age Pension means test.

My Comments – This measure will make the tax benefits from the Transition to Retirement (TTR) strategy less advantageous for those under age 60 based on the removal of the 0% tax rate in pension phase. If you are in a TTR strategy this mixed with the contribution threshold reduction may change the validity of this strategy for you.

Low Income Superannuation Tax Offset (LISTO)

From 1 July 2017, a Low Income Superannuation Tax Offset (LISTO) will apply to reduce tax on superannuation contributions for low-income earners. The LISTO is a non-refundable tax offset to superannuation funds, based on the tax paid on concessional contributions made on behalf of low income earners. The offset is capped at $500 and will apply to members with adjusted taxable income up to $37,000.

Contribution rules for those aged 65 to 74

From 1 July 2017, individuals under the age of 75 will no longer have to satisfy a work test and will be able to receive contributions from their spouse.

Superannuation balances of low-income spouses

From 1 July 2017, the Government will increase access to the low-income spouse tax offset – which provides up to $540 per annum for the contributing spouse – will apply where the low-income spouse’s income is up to $37,000 (increased from the current $10,800).

Anti-detriment payments

From 1 July 2017, the anti-detriment payment (which, broadly speaking, compensates certain beneficiaries of superannuation benefits paid because of the death of a member, for the effect of tax on contributions) will be abolished.

My Comments: For any clients who have existing anti detriment benefits in place this should not impact those existing benefits however we will need to review as the legislation progresses.

Tax deductions for personal superannuation contributions

From 1 July 2017, individuals up to age 75 will be able to claim an income tax deduction for personal superannuation contributions. This will apply regardless of employment status (i.e., wholly employed, self employed or a partially employed/self-employed).

Social Security and Family Payments

Youth Employment Package — Youth Jobs PaTH

From 2016/17, the Government will establish a Youth Jobs PaTH program for young job seekers aged under 25 years to improve youth employment outcomes. The pathway has three elements:

- Industry-endorsed pre-employment training (Prepare) — from 1 April 2017, training for up to six weeks will be provided to develop basic employability skills, including those required to identify and secure sustainable employment.

- Internship placements of up to 12 weeks (Trial) — from 1 April 2017, up to 30,000 internship placements will be offered each year to enable businesses and job seekers to trial their employment fit. Job seekers will receive a $200 fortnightly incentive payment and businesses will receive $1,000 upfront to host an intern.

Job seekers must be registered with jobactive, Disability Employment Services or Transition to Work, and have been in employment services for at least six months to be eligible for the internship program.

Youth Bonus wage subsidies (Hire) — from 1 January 2017, employers will receive a wage subsidy of up to $10,000 for job seekers under 25 years with barriers to employment and will continue to receive up to $6,500 for the most ‘job-ready’ job seekers. Job seekers must be registered with jobactive or Transition to Work, and have been in employment services for at least six months for employers to be eligible for the wage subsidy.

Youth Employment Package – Work for the Dole

From 1 October 2016, the most job ready job seekers will enter the Work for the Dole phase after 12 months participating in job active, rather than the current six months.

Jobs for Families Package

Child Care Subsidy, Additional Child Care Subsidy and Community Child Care Fund will now apply 1 July 2018, (rather than the previously announced 1 July 2017). Child care fee assistance will continue to be provided under the Child Care Benefit, Child Care Rebate, Jobs, Education and Training Child Care Fee Assistance, Community Support Program and Budget Based Funded Program until 30 June 2018.

The Interim Home Based Carer Subsidy Pilot Programme (Nanny Pilot Programme), which commenced on 1 January 2016 and subsidises care provided by a nanny in a child’s home, will also be extended for six months to 30 June 2018. The hourly fee cap will be increased from $7 to $10 from 1 June 2016. The cost of this increase will be met from within the existing resources allocated to the programme.

Aged Care

My Aged Care — consumer access

The Government will provide $136.6 million over four years from 2016-17 to support the operation of the My Aged Care contact centre. The funding will assist the contact centre to meet the significant increase in demand for assistance from customers interacting with the aged care system.

Scott Malcolm has been awarded the internationally recognised Certified Financial Planner designation from the Financial Planning Association of Australia and is Director of Money Mechanics. Money Mechanics is a fee for service financial advice firm who partner with clients in Melbourne, Canberra and Sydney to achieve their life and wealth outcomes. We are authorised to provide financial advice through PATRON Financial Advice AFSL 307379.

The information provided on this article is of a general nature only. It has been prepared without taking into account your objectives, financial situation or needs. Before acting on this information you should consider its appropriateness having regard to your own objectives, financial situation and needs.